– IT and SAP budgets continue to rise

– S/4HANA on-premise remains at a high level

– Satisfaction with SAP industry strategy could be improved

Walldorf, April 27, 2023 – IT and SAP budgets in Germany, Austria and Switzerland (DACH) will continue to rise this year – this is a key finding of the Investment Report 2023* published by the German-speaking SAP User Group e. V. (DSAG). S/4HANA will also gain in terms of relevance for companies. But Business Suite is still the preferred solution. The Business Technology Platform (SAP BTP) continues to gain approval. SAP’s pricing policy in the cloud environment and its industry strategy are criticized.

Compared to 2022, the IT budgets of the companies surveyed are increasing at 54 percent, remaining the same at 26 percent and decreasing at 15 percent. SAP budgets are increasing at 52 percent, remaining the same at 31 percent and decreasing at 15 percent. „The upward trend in IT budgets and budgets for SAP solutions, which was already evident last year, is continuing at approximately the same level. This speaks for confidence among companies that crisis situations will be mastered well,“ summarizes DSAG Chairman Jens Hungershausen and adds: „In addition, some established SAP solutions will soon be coming out of maintenance and the project pipelines of the companies are well filled – budget is needed accordingly.

S/4HANA and transformation projects require time

Another question revolves around digital transformation and the progress companies are making. This question was not asked last year, so the comparison to 2021 must be used. Very far is 5 percent (2021: 2 percent) 39 percent describe themselves as far, the identical value as in 2021. 52 percent see themselves as not very far, an increase of two percentage points compared to the report two years ago. „This indicates that companies set other priorities during the pandemic and may have initially postponed planned digitization projects due to the existing uncertainties,“ says Jens Hungershausen.

When asked about the SAP ERP solutions used, SAP Enterprise Resource Planning, or SAP Business Suite, is still clearly in the lead with 79 percent (2022: 75 percent), ahead of S/4HANA On-Premise with 41 percent (2022: 32 percent). This is followed by S/4HANA Private Cloud with 8 percent (2022: 6 percent) and S/4HANA Public Cloud with 3 percent (2022: 2 percent). „The following applies to S/4HANA projects in particular and transformation projects in general: depending on the complexity, migration projects can take several years. A real transformation requires new technologies to be evaluated and introduced, and processes to be rethought,“ says Jens Hungershausen. In addition, migration projects often involve replacing old code or existing processes and cleaning up master data. The industry association believes that SAP has a duty to empower its partners to provide adequate support for migration projects.

End of maintenance pushes switch to S/4HANA

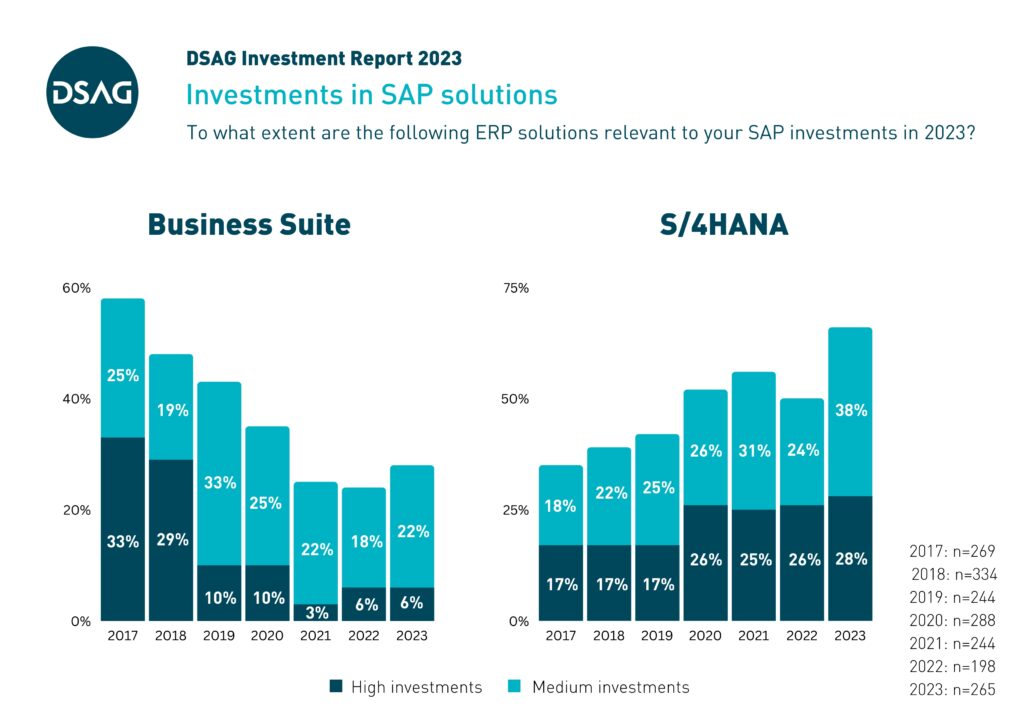

Business Suite is relevant for SAP investments in 2023 at 6 percent (2022: 6 percent) for high investments and at 22 percent (2022: 18 percent) for medium investments. In S/4HANA, 28 percent (2022: 26 percent) plan high investments and 38 percent (2022: 24 percent) medium investments. The willingness of DSAG member companies to invest is not surprising. After all, companies will have to switch from their old ERP system to S/4HANA by 2027 or 2030 at the latest. Then older systems will fall out of maintenance. „2027 still sounds far away. Nevertheless, the effort involved in such a migration should not be underestimated. Companies need strong partners with sufficient resources at their side,“ says Jens Hungershausen. The necessary availability of partners for the short time span until 2027 will be an additional external challenge for the success of the project. Companies are therefore called upon to act.

BTP as a central element of the SAP strategy

When it comes to SAP cloud solutions, 24 percent say they will make high and medium investments in the SAP Business Technology Platform (BTP). Investment in this case means increasing spending in cloud solutions, including subscriptions. In second place in the ranking of SAP cloud solutions is SAP SuccessFactors, with high and medium investments by 17 percent of respondents. SAP Customer Experience is in third place with 9 percent. „SAP positionizes BTP as a central element of its strategy. Against this background, it is understandable that the survey participants are considering this SAP cloud solution,“ says Jens Hungershausen. From DSAG’s point of view, it is positive that the first migration services are now being developed to support the conversion of existing integration architectures to BTP’s Integration Suite, for example. However, the costs for development, quality assurance and use of the services without productive reference are too high – as are the costs for general operation. DSAG is in discussion with SAP about this.

BTP relevant for data and analytics

In the Business Technology Platform, the area of data and analytics (e.g., SAP HANA Cloud, SAP Analytics Cloud) with 38 percent high and medium investments (2022: 39 percent) is ahead of application development and automation and integration with 17 percent each for high and medium investments. Artificial intelligence brings up the rear with three percent for high and medium investments. „The importance of data and analytics remains at the previous year’s level and underscores the importance of agile action in fast-moving times. Real-time analyses, forecasts and concrete planning play a major role,“ says Jens Hungershausen. SAP’s „SAP Datasphere“ offering, which is designed to make it easier for business customers to process and analyze critical business information, fits into this context. It addresses DSAG’s long-standing demand for the consolidation of SAP and non-SAP data.

Cloud pricing policy put to the test

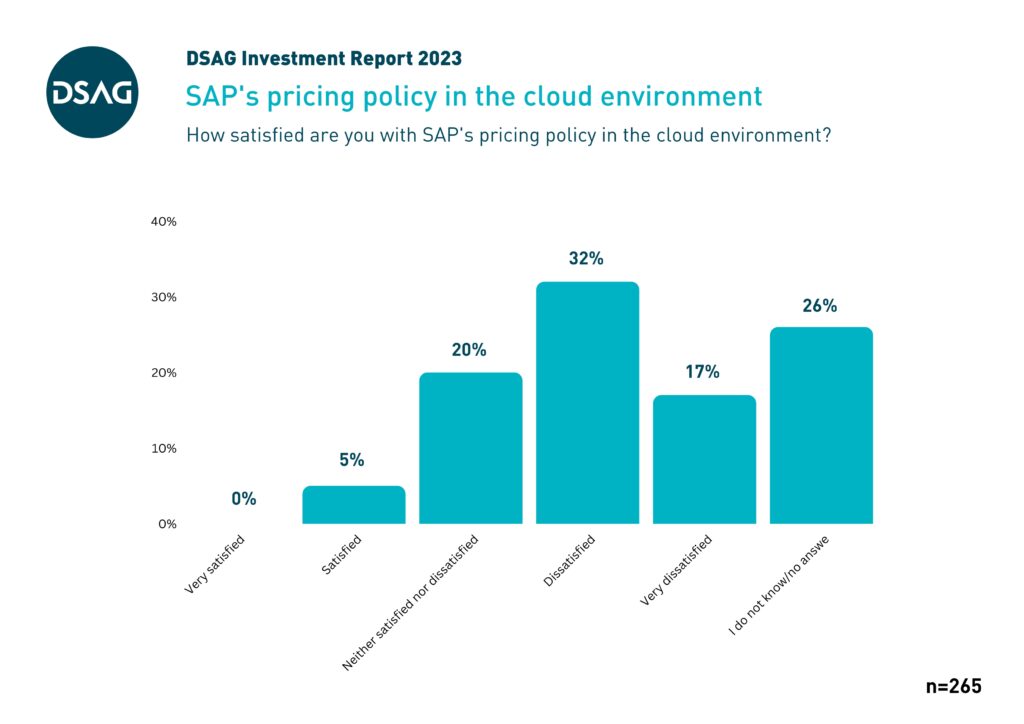

This investment report also asked for the first time for an assessment of SAP’s pricing policy in the cloud environment. Five percent describe themselves as satisfied. Twenty percent rate their status as neither satisfied nor dissatisfied, and 26 percent of respondents did not provide any information. „Of course, this result does not hide the fact that almost half of the respondents do not like SAP’s pricing policy. But I see this as a fundamental problem that customer companies have with all providers of cloud solutions,“ says Jens Hungershausen, summing up the results. And he adds: „The planned annual price increase for SAP cloud services has caused a lot of criticism among DSAG members. We are convinced that reliable mechanisms for price development are needed. This is another reason why these values are like an echo of a reaction from SAP customers already shown last year. A recurring annual increase in prices makes it more difficult for companies to move to the cloud.

No across-the-board price increases

DSAG has communicated its expectations to SAP in this regard – namely, a holistic regulation that benefits all user companies and is not based on across-the-board annual increases. During the DSAG keynote at the 2023 Technology Days, the interest group called on SAP to refrain from applying the 3.3 percent price increase to cloud services that have been put into maintenance mode or discontinued. „If customers are asked to pay even more for cloud solutions that have already been discontinued or are no longer maintained, this creates a negative impression of the manufacturer – and from DSAG’s point of view, that cannot be SAP’s goal,“ says Jens Hungershausen.

Agreement with SAP industry strategy could be improved

As far as the satisfaction of the survey participants with the SAP strategy for their respective industry is concerned, 22 percent are satisfied, 39 percent are neither satisfied nor dissatisfied, and 23 percent are dissatisfied. 10 percent said they were very dissatisfied. 6 percent did not provide any information. Among those who are satisfied are, for example, the high-tech and electronics industries, the public sector and the consumer goods industry. Among the dissatisfied, the health care sector, the metal, wood and paper industry, and the chemical industry can be mentioned.

From DSAG’s point of view, satisfaction in the public sector in particular was due to SAP’s announcement last year that it would operate cloud sites exclusively for public administration in the future. The dissatisfaction with the industry strategy can be seen, for example, in the healthcare sector. For example, SAP has announced that there will be no successor solution for the SAP industry solution SAP Patient Management in the S/4HANA ERP world, thus presenting clinics and hospitals with major challenges. A DSAG survey in the Healthcare working group confirms the results of the investment report and states: The SAP strategy does not fit the hospital reality.

Companies invest in further training

When it comes to training, companies provide each employee with a certain budget. For 21 percent of respondents, this budget for 2023 is between 1,000 and 1,999 euros, for 18 percent between 500 and 999 euros, and for 17 percent between 2,000 and 4,999 euros. Four percent have 5,000 and more euros available, and 12 percent less than 500 euros. „For projects such as the introduction of the SAP Business Technology Platform or other cloud solutions, experience and specific know-how are needed. If this has to be built up first, a training budget makes perfect sense. The fact that a wide range is covered here shows how different the knowledge is in the respective areas,“ summarizes Jens Hungershausen. Support is provided here, for example, by the DSAG Cloud Enablement Initiative, which was launched by the DSAG Academy together with selected partners.

Cybersecurity continues to gain relevance

Among the overarching topics with relevance for investment planning, cybersecurity is clearly in first place at 88 percent (2022: 78 percent) with high and with medium relevance. It is followed by the automation of processes, which has a high and medium relevance for 68 percent. The importance of cybersecurity in particular is not unexpected. „Preventing a hacker attack is indeed impossible. But there are a number of measures that companies and users can take to prepare themselves,“ says Jens Hungershausen. Among other things, DSAG considers a security dashboard that has been on the list of demands for some time to be an important element in anticipating security-related attacks. Together with SAP, DSAG is working on a corresponding solution that automatically shows which security-relevant settings need to be made and where security gaps exist in the company’s respective SAP landscape.

„With a security awareness campaign, DSAG supports its member companies in becoming aware of the topic of security and how to deal with threats to SAP systems. Since people represent the highest risk to IT security alongside the technology itself, they need to be sensitized to the possible threat scenarios,“ says Jens Hungershausen. Specifically, the industry association offers various training courses designed to help employees identify and ward off possible threats at an early stage and prevent consequences from arising in the first place.

*Basis for the survey

Between January 24 and February 15, 2023, 265 participants in the DACH region took part in the survey. CIOs, CC managers and contact persons from member companies were surveyed. Only one person per member company was contacted and asked to participate. 188 DSAG members took part from Germany, 35 from Switzerland and 31 from Austria. 11 participants came from other countries. The top 5 industries represented see mechanical engineering, equipment and component manufacturing in first place with 11 percent. This was followed by the public sector and the consumer goods industry, each with 9 percent. Healthcare and wholesale trade, each with 7 percent, complete this ranking.

Downloads

Pressekontakt

Für Fragen und Interview-Wünsche stehen wir Ihnen gerne zur Verfügung. Bitte kontaktieren Sie uns!

Thomas Kircher

Deutschsprachige SAP-Anwendergruppe e. V. (DSAG)

+49-6227-35809-66

presse@dsag.de

Julia Theis

Deutschsprachige SAP-Anwendergruppe e. V. (DSAG)

+49-6227-35809-74

presse@dsag.de

Unsere PR-Agentur (DE und AT)

Flutlicht GmbH

+49-911-474-950

dsag@flutlicht.biz

Unsere PR-Agentur (CH)

Jenni Kommunikation

+41-44-388-60-80

info@jeko.com

Presseverteiler

Für eine Registrierung in unserem Presseverteiler schreiben Sie bitte eine formlose E-Mail an presse@dsag.de unter Angabe Ihres Vor- und Nachnamens, Ihrer Redaktion sowie Ihrer Kontaktdaten. Dann erhalten Sie zukünftig die DSAG-Pressemeldungen per E-Mail.