- IT budgets and sales less affected than feared

- Sustainable integration concepts needed

- Future cloud: good and bad news

There is no doubt that the digital revolution is underway. But the COVID-19 pandemic has served to highlight some of the existing deficits in business and society: the true potential of digitalization hasn’t yet been fully exploited. Overall, revenues and IT budgets haven’t been as badly impacted by the pandemic as was feared last year, according to a recent survey conducted by the German-speaking SAP User Group (DSAG) among its members in Germany, Austria and Switzerland. This gives companies more leeway to deploy intelligent technologies in an integrated way, rethink established processes and build new business models – all in keeping with this year’s DSAGLIVE slogan, „Courage and Intelligence – Now“. For example, in terms of implementing consistent, end-to-end processes, there is still a huge need for action and information when it comes to integrating SAP applications with the cloud and hybrid environments. The same goes for harmonizing data models. Furthermore, there is still room for improvement in users‘ acceptance of cloud solutions.

First, the good news: for many DSAG members, the economic impact of the coronavirus pandemic was not as bad as feared. While revenues fell at 74 percent of companies in 2020 according to the DSAG survey, only 42 percent saw a decline this year. Moreover, revenues rose at 29 percent of the firms surveyed this year – an increase of 22 percent over last year (7 percent in 2020). 29 percent of the companies surveyed did not see any impact on their revenues from the pandemic (19 percent in 2020).

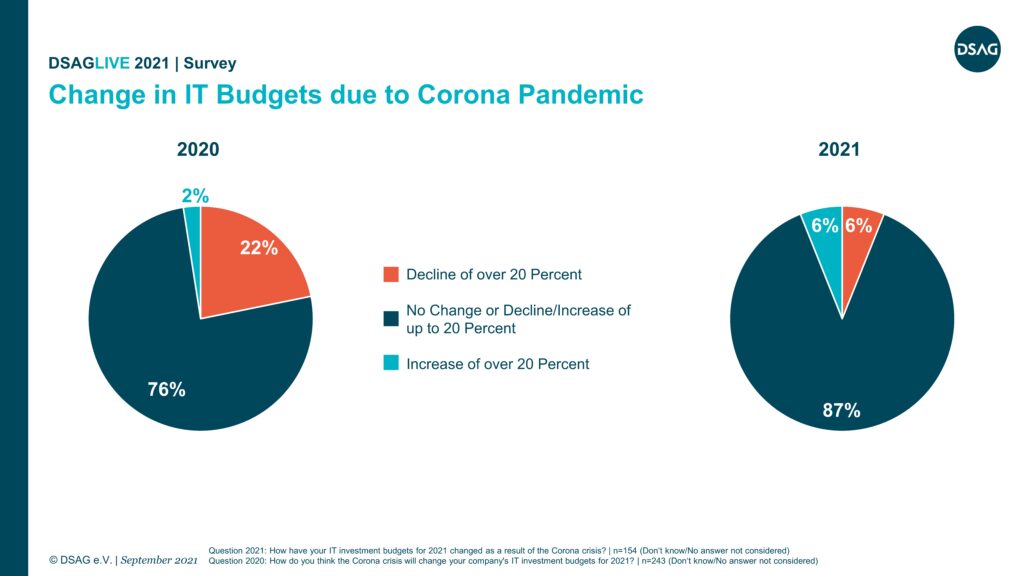

In terms of IT budgets, only 2 percent of companies surveyed last year expected their budgets to increase by more than 20 percent. This year, 6 percent of companies saw that happen. In last year’s survey, 22 percent expected budget cuts of more than 20 percent, but only 6 percent of survey participants actually saw their budgets fall by that extent. „This is a positive development that should give companies some confidence. Now it’s important not to look back, but to organize and strategize forward,“ explains DSAG Chairman Jens Hungershausen.

The digital Dilemma

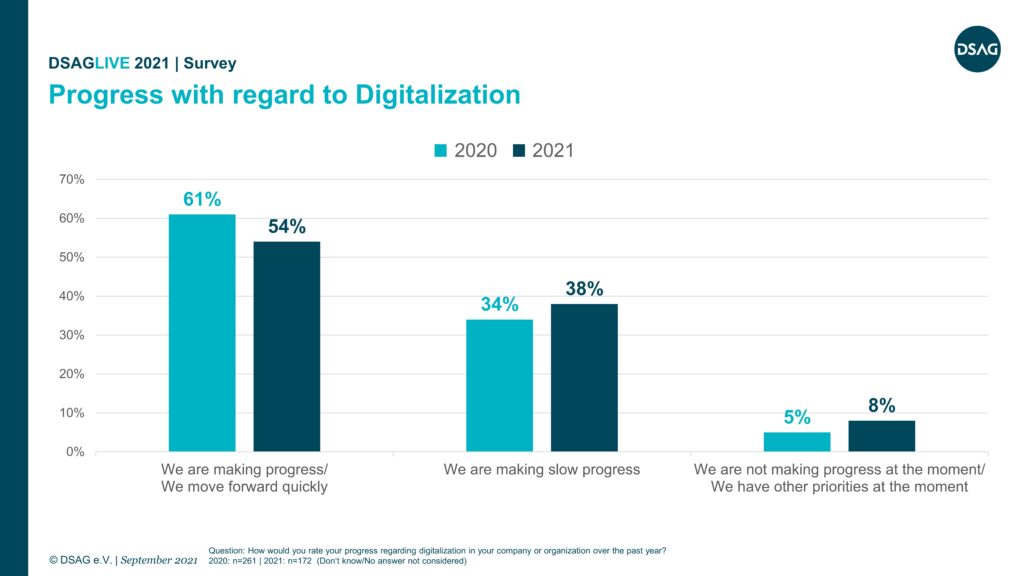

The pandemic has, however, led to a dilemma: right now, many companies must juggle securing their present viability with preparing for the digital future. „Many companies still aren’t brave enough to make changes. The momentum of 2020 has subsided, which is partly the result of a lack of urgency to take action, thwarting the development of innovations that are potentially critical to a company’s survival,“ says Jens Hungershausen. 54 percent of companies are confident they are making good progress with digitalization. But last year, this figure was 61 percent. The number of companies that said they were making slow progress rose to 38 percent (34 percent in 2020), while 8 percent said they are not making any progress and/or have other priorities (5 percent in 2020).

Intelligent networking

Another focus of the survey was the progress made by companies in integrating SAP applications in cloud and hybrid environments. In 2019, SAP unveiled a vision for this: a foundation for building efficient, end-to-end processes. But only 28 percent of the companies who gave a response here rated the status of the integration between SAP applications, partner and third-party solutions as good. 44 percent rated it as satisfactory, 14 percent as sufficient and a further 14 percent as inadequate. „In terms of integration, there’s still plenty left to do. SAP has already made considerable headway in this area. But the results should be seen by SAP as another major wake-up call,“ says Jens Hungershausen, commenting on the survey findings.

Need for action on harmonization

When it comes to the suite qualities in SAP-to-SAP integration, 48 percent rated overall security as good or very good, ahead of integrated reporting (32 percent) and coordinated product maintenance (31 percent), as well as consistent user interfaces (28 percent). These were followed in the rankings by standardized workflow and predefined end-to-end processes, which were each rated as good/very good by 19 percent of respondents. Harmonized data models were only rated as good/very good by 16 percent of companies that responded here. „Harmonized data models play a key role in terms of intelligent, cross-application networking and integration. The fact that only 16 percent of the companies surveyed rate this as good or very good suggests there’s still a huge need for more action and information here,“ explains Jens Hungershausen.

Investing in the digital future

One potential technological basis for business process transformation is S/4HANA. According to a joint survey conducted by DSAG and the Americas‘ SAP Users‘ Group (ASUG) in April-May 2021, the ERP system is continuing to grow in importance. 44 percent of the DSAG members surveyed have either launched S/4HANA projects or already have one up and running. This represents a significant increase of 9 percent over last year (35 percent). Moreover, the percentage of companies planning to implement S/4HANA, but which haven’t yet started a project, has fallen by 10 points to 37 percent. Just 9 percent are not planning to introduce S/4HANA. „There’s still lots of potential in companies to implement intelligent technologies in a holistic, value-adding way. But conventional migration hasn’t yet been fully replaced by organizational change projects and digital end-to-end processes. I see both ourselves as DSAG and also SAP as responsible for doing more intense educational work,“ says Jens Hungershausen firmly.

No question: it’s all about the cloud

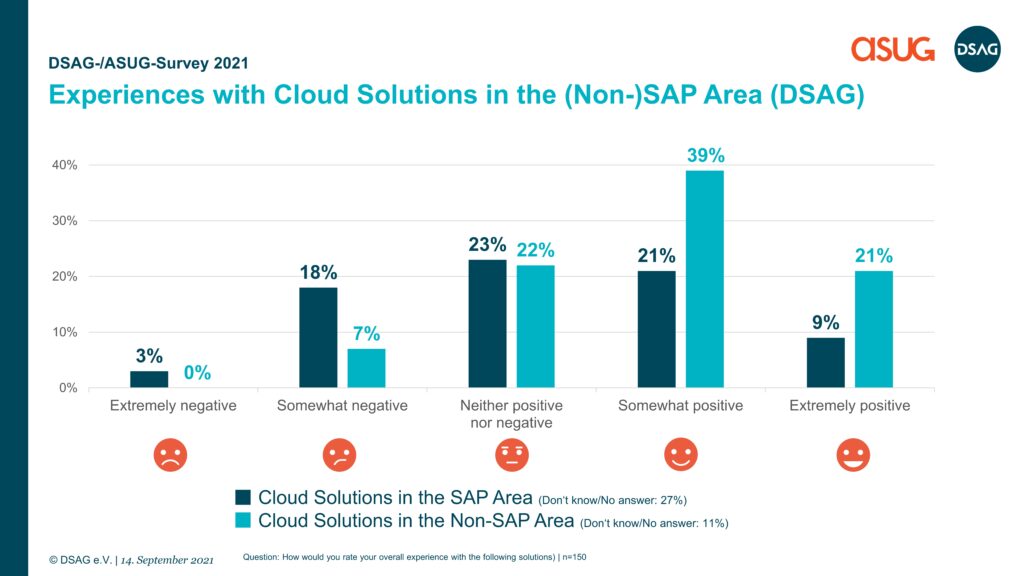

The cloud is critical for SAP customers and there’s no question it represents the future. This was also clear from the recent ASUG and DSAG survey, which revealed that 46 percent of DSAG members generally view the cloud as positive. Meanwhile, 26 percent have neither a positive nor negative view , while 27 percent view the cloud as negative. „Approval of cloud solutions in German-speaking countries continues to rise, even if it’s a more reserved increase than among ASUG members. This is likely attributable to the continued reluctance to move sensitive enterprise data to the cloud,“ explains Jens Hungershausen. But prior experiences with cloud solutions also play a big role. Only 30 percent of DSAG members have had good experiences in the SAP segment. For non-SAP, this figure was 60 percent. „That one-third approval is a surprising finding. It shows that SAP needs to work harder to solve critical issues like licensing, integration and security, and to build trust – for example, with sustainable concepts and lots of persuasion,“ adds the chairman.

Conclusion

Courage and intelligence are now needed to tackle the challenges posed by digital transformation, and efforts need to be doubled down. The fact that revenues and IT budgets have fallen by less than was feared is a good sign. Now, the importance of networks and cooperative approaches really needs to be hammered home. This is best done by building trust and casting any misgivings aside. SAP can support this with intelligent, integrated solutions. These are good, pioneering and sustainable approaches that SAP is presenting. But in many industries, there’s still a need for more detailed concepts and more targeted information so that customers can rely fully on SAP for their digital transformation.

Scope of survey

A total of 173 DSAG members from Germany, Austria and Switzerland participated in the survey from June 25 to July 15, 2021. They consisted exclusively of user companies, with one person from each firm participating in the survey, including CIOs, CC heads and other representatives. 51 percent of the companies surveyed were from the manufacturing sector, 37 percent from services and retail, and a further 12 percent from other sectors. 70 percent of the companies were headquartered in Germany, 13 percent in Switzerland and 13 percent in Austria. Over a third of the organizations employed 500 to 2,499 staff, a further third 5,000 or more staff, while 15 percent had 2,500 to 4,999 employees and 14 percent had up to 499 employees.