Walldorf, March 21, 2024 – The Investment Report 2024* of the German-speaking SAP User Group (DSAG) confirms this: IT and SAP investment budgets continue to rise – however at less companies than in 2023. At the same time, the willingness to invest in S/4HANA is growing, but user companies see a need for discussion when it comes to the SAP S/4HANA cloud strategy. RISE and GROW with SAP appear to be gaining in importance among respondents. According to the DSAG Investment Report 2024, the topic of artificial intelligence (AI) may also increase. DSAG member companies are also convinced that the importance of SAP for their companies will continue to grow.

IT and SAP investment budgets will continue to rise at many companies in 2024. However, less than last year. The overall IT budget will increase at 43% of the companies surveyed in Germany, Austria and Switzerland (DACH), compared to 54% a year ago. It will remain the same at 36% (2023: 26%) and decrease at 18% (2023: 15%). In terms of investments in SAP, 46% of the companies surveyed saw their budget increase (2023: 52%), 32% saw it remain unchanged (2023: 31%) and 19% saw it decrease (2023: 15%).

„The proportion of companies whose IT and SAP investment budgets remain the same or decrease has risen significantly. Market conditions are difficult and uncertain. It is therefore understandable that companies are taking a wait-and-see approach – but this is not recommended if they want to remain competitive in the long term,“ says Jens Hungershausen, DSAG Chairman of the Board.

Business Suite remains the frontrunner

When asked about the SAP Enterprise Resource Planning (ERP) solutions used, SAP ERP, or SAP Business Suite, remains the clear leader in 2024 with 68% (2023: 79%), ahead of S/4HANA On-Premises with 44% (2023: 41%). The use of S/4HANA Private Cloud and S/4HANA Public Cloud has increased overall. For example, 11 percent (2023: 8 percent) rely on S/4HANA Private Cloud and 6 percent (2023: 3 percent) on S/4HANA Public Cloud. „The cloud operating models for S/4HANA continue to play a subordinate role. This is not surprising, as companies face numerous challenges when switching to the cloud. Strategic reasons, such as investments already made and security concerns for critical IT infrastructures, certainly also play a role here,“ explains the DSAG Chairman of the Board.

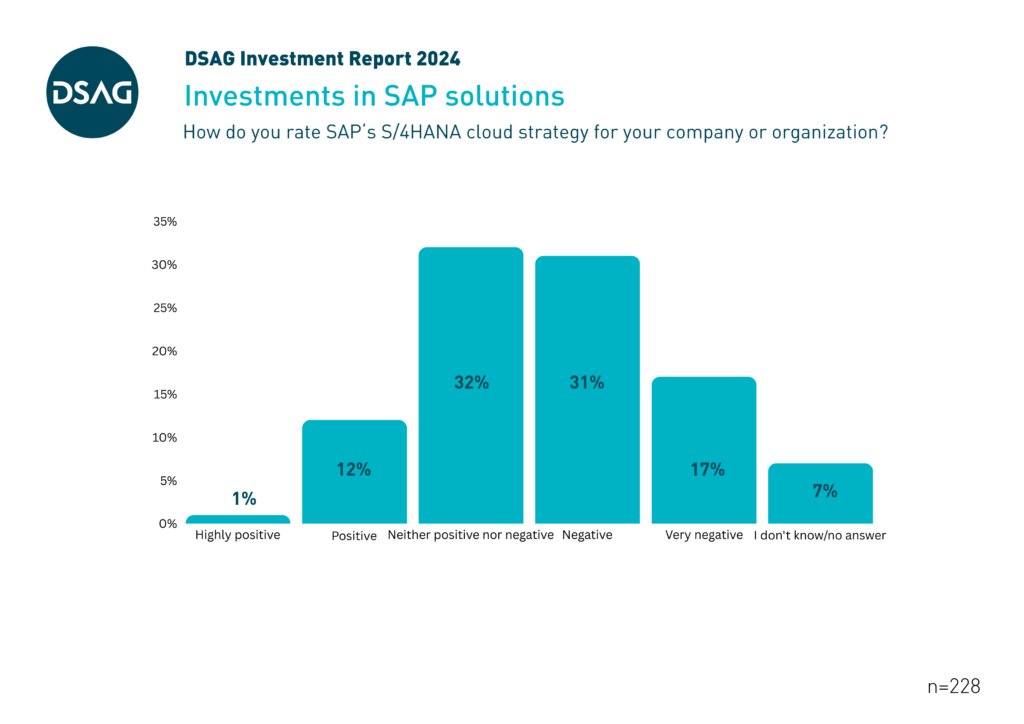

Need for discussion on S/4HANA cloud strategy

For the first time, DSAG member companies were asked how they assess SAP’s S/4HANA cloud strategy. It should be noted that the DSAG survey took place in part before the launch of the new SAP program RISE with SAP Migration & Modernization, which includes incentive measures when moving to the cloud. „The DSAG members surveyed are critical of SAP’s S/4HANA cloud strategy. Only 13 percent of those surveyed had a positive opinion, just under half had a negative one,“ explains Jens Hungershausen.

Topics such as greater standardization, more flexibility and higher security were named as positive in the investment survey. „At the same time, respondents want to ensure that on-premises customers can also fully consume the strategic innovations,“ summarizes Jens Hungershausen.

Willingness to invest in S/4HANA is growing

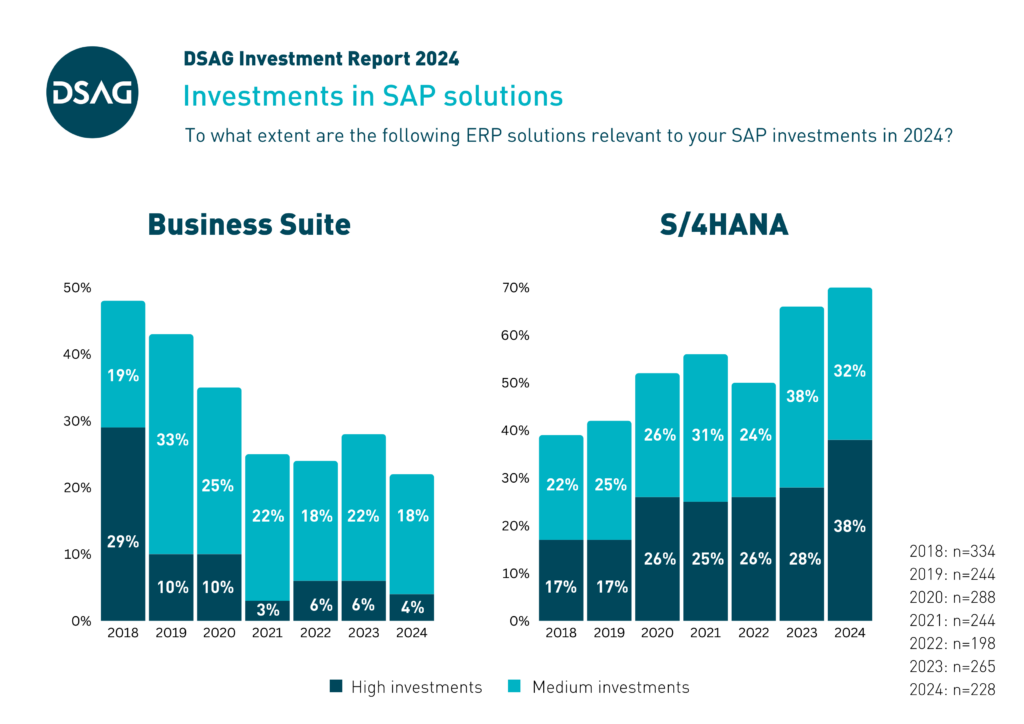

However, this assessment has hardly any impact on the willingness to invest in S/4HANA overall. When asked about the relevance of the Business Suite for SAP investments in 2024, four percent of companies are planning high investments (2023: 6 percent) and 18 percent medium investments (2023: 22 percent). For S/4HANA, high investments are relevant for 38 percent (2023: 28 percent) and medium investments for 32 percent (2023: 38 percent). „Investments in S/4HANA are continuing to increase. The increase in high investments in particular suggests that the efforts of DSAG and SAP to support user companies during the transformation are bearing fruit. Nevertheless, I would have expected a higher willingness to invest in S/4HANA – especially in view of the end of maintenance in 2027 and the resulting very tight time window for migration,“ says Jens Hungershausen.

RISE with SAP makes gains

When asked about the role of RISE with SAP for companies, 16% of respondents stated that they already use or plan to use the service. Eight percent stated that they were not aware of the offering. 61 percent of respondents do not plan to use the service. In the 2022 DSAG Investment Report, 57 percent of respondents stated that they are very and somewhat unlikely to consider RISE with SAP in their organizations. „Many of the companies surveyed want to stay on-premises with their SAP ERP systems. At the time of the survey, they did not see any advantages of migrating to the cloud and there is also a lack of trust in SAP in some cases,“ says Jens Hungershausen. The respondents also cited an unfavorable cost-benefit ratio, increased testing efforts, limited expansion options and the high dependency on SAP, including a lack of exit options, as reasons.

GROW with SAP does not currently play a major role in the DSAG community. 55 percent of respondents state that they do not want to use the offering. „S/4HANA Public Cloud is not an option for many of those surveyed. GROW with SAP is seen more as an offer for new customers who choose a greenfield approach,“ summarizes Jens Hungershausen.

More understanding of business realities desirable

„It will be exciting to see whether the tide turns for SAP with the aforementioned ‚RISE with SAP Migration and Modernization‘ programme,“ says Jens Hungershausen. At the end of January 2024, SAP responded to a DSAG demand that on-premises customers should not be left out in the cold. Among other things, the program provides for investments already made to be credited. „Transformations are extensive and companies often have different release statuses and expansion stages. There is no one-size-fits-all approach here. SAP must recognize this and provide companies with even more intensive support during their transformation,“ says Jens Hungershausen.

Business Technology Platform takes the lead

In terms of SAP cloud solutions and their relevance for investments in 2024, SAP Business Technology Platform (BTP) is in first place with high and medium investments of 33% (2023: 24%), ahead of SAP SuccessFactors. 21% (2023: 17%) are planning high and medium investments for SuccessFactors. SAP Customer Experience (CX) follows in third place with 12 percent (2023: 9 percent).

In terms of the Business Technology Platform, 34% (2023: 38%) of respondents are planning high and medium investments for analytics solutions, followed by integration solutions with 27% (2023: 17%). For application development and automation, 17% of respondents (2023: 17%) are planning high and medium investments in the BTP.

Cybersecurity continues to dominate IT topics

In addition to pure SAP topics, the survey also focused on the relevance of overarching topics for investment planning. With 88% (2023: 88%) of high and medium relevance, cybersecurity is clearly in first place, followed by process automation with 75% (2023: 68%) and digital competence 63% (2023: 50%). „The continued importance of cybersecurity is not surprising. The use of artificial intelligence (AI) is also increasing the dangers. It is therefore all the more pleasing that SAP has complied with the long-standing DSAG demand and presented an SAP security dashboard at the DSAG Technology Days 2024,“ says Jens Hun-gershausen. Overall, one thing is needed above all: high-quality software and cloud solutions that meet the increased requirements for operation and security and offer a functional equivalent to previous on-premises solutions. From DSAG’s point of view, it is essential that SAP supports customers with implementable solutions and standards across the entire portfolio.

IT governance plays a role for 56% (2023: 44%) of respondents and sustainability for 51% (2023: 48%) of respondents. Sustainability therefore remains an important topic. „From DSAG’s point of view, SAP would position itself more as a sustainability enabler if the Green Ledger were made available to all S/4HANA customers,“ says Jens Hungershausen.

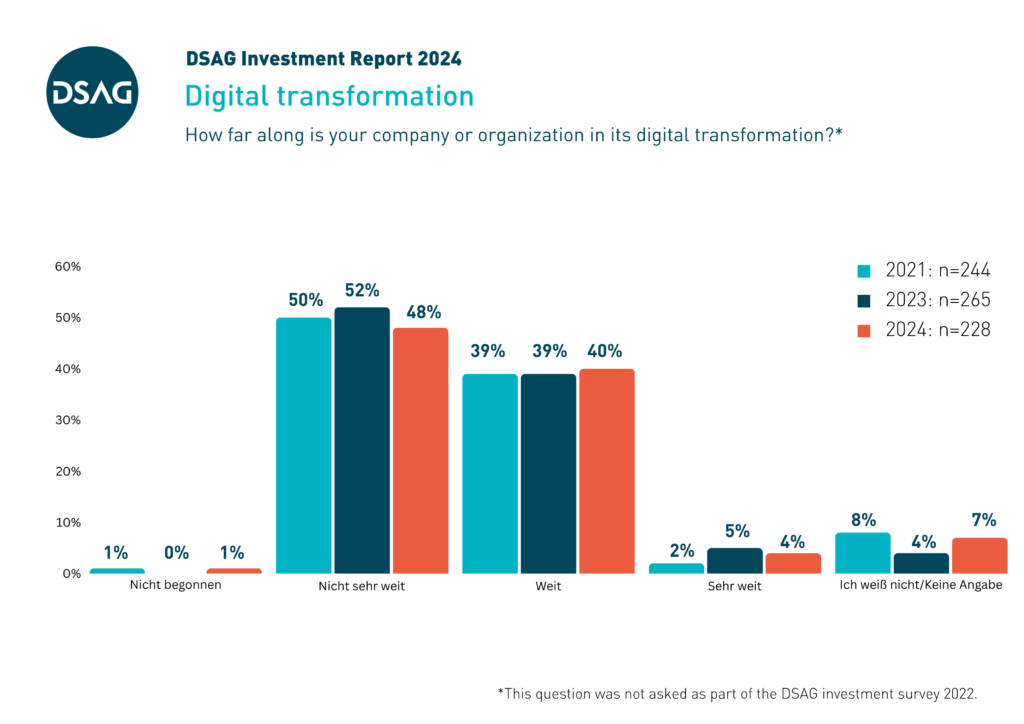

Digital transformation seems to be stagnating

Another question revolves around the digital transformation and the progress made by companies. „It is noticeable here that companies have not made any progress. That is problematic. Because no transformation means stagnation and a constantly widening gap to the competition. If you wait too long, you will quickly fall behind. Instead, companies must be able to implement innovations quickly in order to secure Germany as a business location,“ says Jens Hungershausen. In 2024, only four percent (2023: 5 percent) of respondents stated that they were very far along in their digital transformation. 40 percent (2023: 39 percent) describe themselves as far along. Not very far is 48%, a drop of four percentage points compared to the DSAG Investment Report 2023.

The relevance of AI is increasing

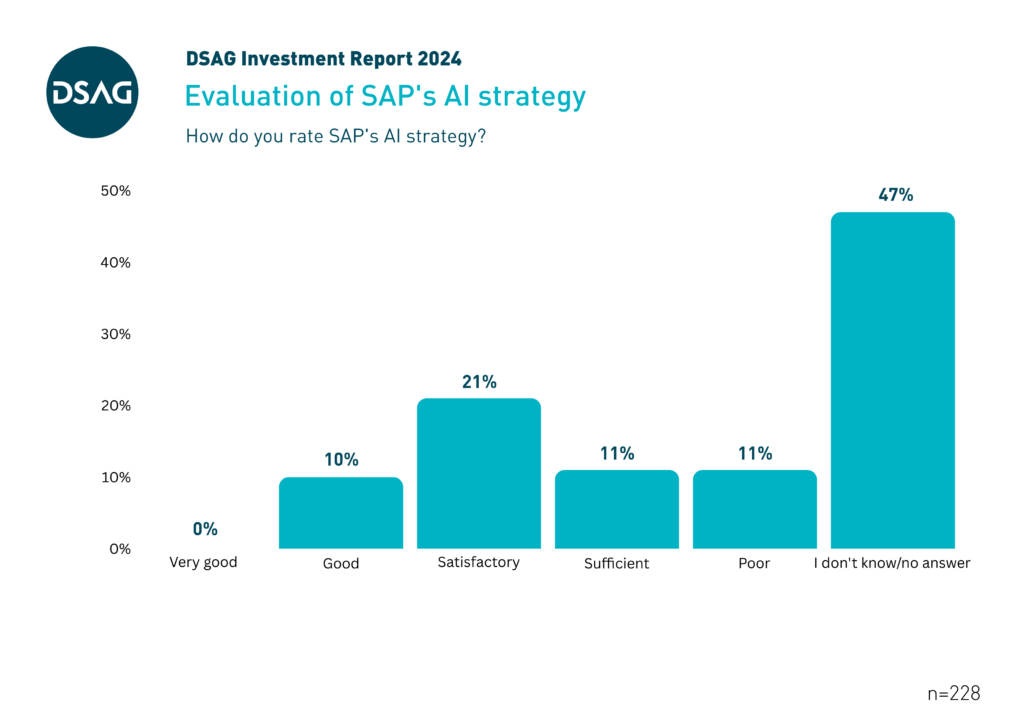

This year, the investment survey once again asked about the relevance of artificial intelligence (AI) for IT investments. In the 2022 investment report, 12% of respondents planned to invest in artificial intelligence/machine learning. Just under two years later, 28% of respondents consider AI to be highly or moderately relevant for their IT investments. For 65 percent, it is only slightly or not at all relevant. Respondents see the benefits of AI primarily in the areas of IT, finance, service, procurement, sales and marketing. „The result shows that many companies are still cautious due to the high dynamics in the AI sector and the associated development of the market. This is where we as DSAG, together with SAP, are called upon to provide more clarity, deliver answers and set milestones for orientation,“ summarizes Jens Hungershausen.

When asked how they rate SAP’s AI strategy, almost half of those surveyed did not provide any information. 21 percent rated it as satisfactory, while 10 percent rated it as „good“. „Our members are particularly critical of the coupling of AI and the cloud. They want easier access to AI and more transparency regarding existing and future possibilities,“ explains Jens Hungershausen. Specifically, the user companies are calling for practical use cases and open integration that also works on-premises.

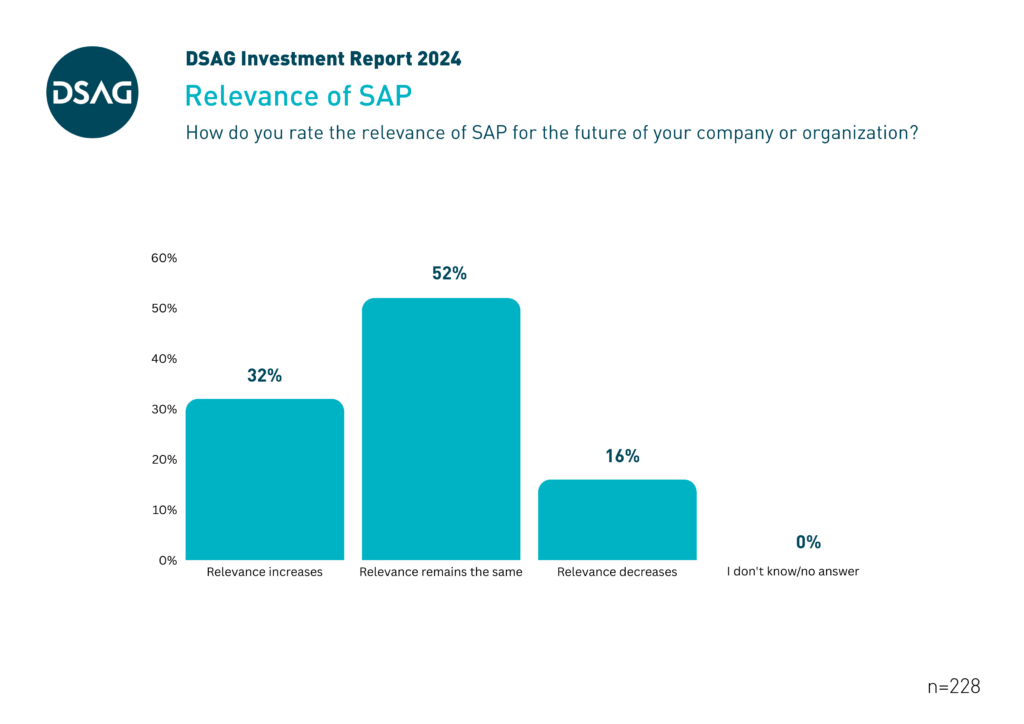

Companies expect SAP to become increasingly relevant

Despite all the criticism of SAP, more than half of those surveyed assume that the relevance of the software manufacturer for the future of their company will remain the same. Almost a third even state that SAP’s relevance is likely to increase. „From SAP’s point of view, this is of course a pleasing result. It is certainly also due to the fact that the software manufacturer has strongly penetrated the system landscapes of companies over the past decades. Replacing existing SAP systems is hardly conceivable in many companies simply because of the expense involved,“ concludes Jens Hungershausen. The industry association still sees significant potential for expansion at SAP when it comes to supporting companies with their transformation projects. To this end, DSAG is available as a mediator and translator between SAP and the user companies in constant exchange and as a critical sparring partner.

Survey basis

In the period from January 23, 2024 to February 13, 2024, 228 people took part in the survey. Only one person per member company was surveyed. These were CIOs, CC managers or contact persons exclusively from user companies. In terms of industries, the top five were dominated by mechanical engineering, equipment and component manufacturing with 12%, followed by the public sector with 11% and the chemical industry with 7%. The automotive industry and the high-tech and electronics industry each accounted for 6 percent of participants. 44 percent of the companies employ 500 to 2,499 employees. 73 percent of the companies are headquartered in Germany, 13 percent in Austria, 9 percent in Switzerland and 4 percent in other countries.

Downloads

Das könnte Sie auch interessieren

Pressekontakt

Für Fragen und Interview-Wünsche stehen wir Ihnen gerne zur Verfügung. Bitte kontaktieren Sie uns!

Thomas Kircher

Deutschsprachige SAP-Anwendergruppe e. V. (DSAG)

+49-6227-35809-66

presse@dsag.de

Julia Theis

Deutschsprachige SAP-Anwendergruppe e. V. (DSAG)

+49-151-25630665

presse@dsag.de

Unsere PR-Agentur (DE und AT)

Flutlicht GmbH

+49-911-474-950

dsag@flutlicht.biz

Unsere PR-Agentur (CH)

Jenni Kommunikation

+41-44-388-60-80

info@jeko.com

Presseverteiler

Für eine Registrierung in unserem Presseverteiler schreiben Sie bitte eine formlose E-Mail an presse@dsag.de unter Angabe Ihres Vor- und Nachnamens, Ihrer Redaktion sowie Ihrer Kontaktdaten. Dann erhalten Sie zukünftig die DSAG-Pressemeldungen per E-Mail.